#020 Volcanoes, Geese and Bitcoin

Dear Subscriber

Welcome to The Bitcoin Adoption Forecast.

The main story this week is visit I had to a renewable mining operation on a volcano in Costa Rica that saved 150 acres of land from leaving the family after 5 generations. The lessons learnt give a blueprint for how Bitcoin mining can accelerate the energy transition, prevent waste, and enhance energy security, without government subsidies.

But first, here’s the highlights of the past few weeks.

Top Picks

The Bitcoin Policy Institute released a report examining Bitcoin and AI's current and future energy impact. The findings highlight a key difference: Bitcoin mining, unlike AI, can lower carbon emissions.

This is mainly because miners can easily switch to renewable energy sources. Also, Bitcoin miners can scale back power consumption during grid stress, potentially offsetting millions of tons of CO2 emissions each year.

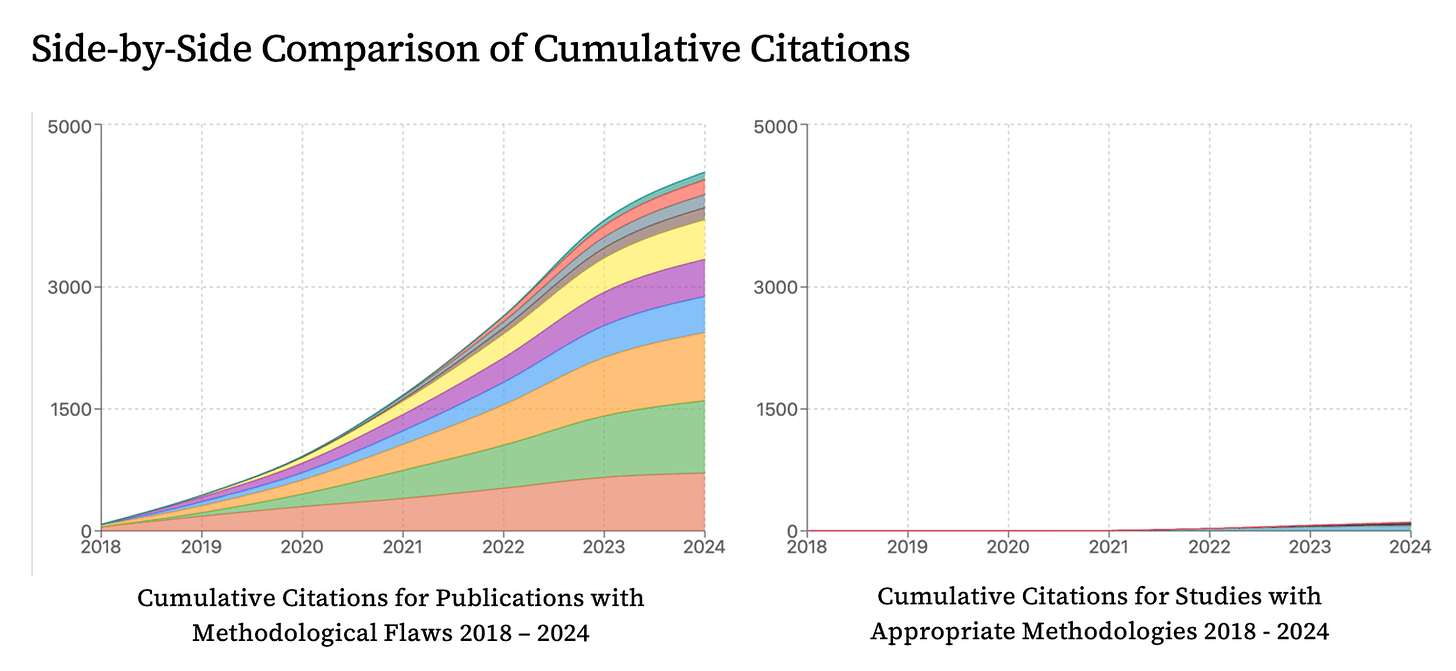

Meanwhile, DARI's latest paper by Simon Collins exposes years of flawed Bitcoin mining research, which influenced media and policy despite fundamental methodological issues.

This research, published between 2014-2021, was widely cited due to journal editors' lack of expertise and over-reliance on de Vries' work. Recent studies with sound methodologies have shown Bitcoin's positive environmental impact.

This has shaped policy discussions and misinformed the public, fostering skepticism around Bitcoin's role in renewable energy. Simon Collins' paper calls for better peer-review practices and a more balanced evaluation of Bitcoin's environmental potential.

Trailblazers

Bitcoin miners are finding innovative ways to repurpose heat from their operations. Recently, @MountainHasher integrated Bitcoin mining rigs to provide heat in a greenhouse. The setup allows heat from the mining rigs to thermostatically control heated soil via a water loop connected to a heat exchanger. The setup optimizes energy use while keeping the greenhouse temperature stable.

Meanwhile, TEPCO, Japan's largest energy provider, has begun mining Bitcoin through its subsidiary, Agile Energy X, using surplus renewable energy.

By redirecting excess power from solar farms in regions like Gunma and Tochigi, TEPCO can reduce wasted energy and accelerate its own green energy expansion, by reinvesting the additional revenue from Bitcoin mining into increasing the size of its solar farm.

Iris Energy has achieved 20 EH/s in Bitcoin mining capacity , all powered by renewable energy. The company plans to expand to 31 EH/s by the end of 2024 and aims for 50 EH/s in 2025.

Features

Earlier this month, on an episode of 21 Voices by Swan Bitcoin, I got featured in a discussion on how Bitcoin mining can support the transition to renewable energy, grid stabilization, and emissions reduction, contributing positively to the environment. (18 min watch)

More recently, Nik of The Bitcoin Layer podcast expanded on my list of 19 lesser-known Bitcoin benefits, emphasizing its role in financial inclusion, environmental impact, and protection against inflation and government overreach, showcasing Bitcoin's global financial revolution. (37 min watch)

And now to the highlight of this episode…

Main Story

This is not a story of terahash and megawatts. It’s the story about Eduardo. A man living less than an hour from me, on the jungle-clad side of the Poás volcano in land his family had owned for 5 generations in Alajuela province of Costa Rica.

Many years ago, he’d had the smart idea to build a renewable microhydro station, to use the untapped power of the river that ran down the side of the volcano.

The project was successful, but capital intensive. He took out a loan to pay for the investment, and life was good. For many years sold the power generated back to the grid, earning a steady profit each year.

Then COVID hit.

As businesses shut down, so did the demand for power. Without warning, ICE, the country’s State Owned Energy Utility contacted him with the message: “We are permanently ending our power purchase agreements with all private electricity generators, effective immediately.”

Half of a million dollars per year gone overnight. What would you do?

Overnight, a profitable business was turned into a debt burden. Eduardo valiantly attempted to transform the property into an eco-tourism destination. This brought in a little money, but nowhere near enough to pay his monthly bank interest repayments.

After months of rising debt, we went to the bank and placed the keys to property on his bank manager’s desk he said “I cannot repay this loan, and I am forfeiting the property, the hydro-station, the dwellings to you.”

His bank manager was shocked. “What am I going to do with a micro-hydrostation?” he said. “Look just hold your horses for 6 months, let’s wait and see.”

Eduardo shrewdly replied, “I can hold my horses, if you can hold your interest.”

They talked, and a mortgage holiday was arranged.

But this was only a stay of execution.

One day, 3 months later, with still no prospect of paying off his debt, Eduardo was talking to his son-in-law. “Have you considered Bitcoin?” He said.

Eduardo’s reaction was the same as mine when I first heard of Bitcoin. “What, that Ponzi scheme? Forget it!” But his son-in-law persisted. “Bitcoin miners need a lot of energy, and they can locate anywhere” he said.

A lightbulb went off in Eduardo’s head.

Within days, he had bought a second hand S19 miner (a latest model mining rig at the time) and hooked it up to the power. Immediately he was earning Bitcoin. Days later, he was sitting in a café eating a meal he’d paid for with the Bitcoin he’d mined. He ran some calculations, and realized he’d found the answer.

His bank manager did not share his enthusiasm for the answer.

Due to Costa Rica having strong user adoption for Bitcoin, banks had already seen a loss of business to Bitcoin as people preferred self-custodial wallets to bank savings accounts; lightning transitions over bank wire transactions.

“We are not allowed to get involved with anything with the name Bitcoin in it” his manager replied… but if you call it a datacenter, I can give you a loan.

Three years later, I visited Eduardo’s 60 Ha property and mining operation. To describe it as paradise is no exaggeration. He employs 40 people for his ecotourism business. Hiking trails and zip lines traverse through the jungle. Free-range animals roam the property. Migratory birds stop to chill on his water reservoir as they fly south. Free-range geese and donkeys roam the property. The land is organic, grows its own food, and sees parties of visitors from schools to executive retreats pass through every week.

He has become an avid supporter of Bitcoin, runs his own node and organizes local meetups to explain the value of Bitcoin to the community.

“Where would you be without Bitcoin mining?” I asked him. He looked wistfully at the property and said - the hydro plant would be rusting. There would be no staff. And I would have lost this property of 5 generations to the bank.

Eduardo’s story is not an anomaly. As Eduardo said to me, “Everything is energy”. Everything we see that looks solid is in fact just energy. The only choice we have is do we waste that energy or do we channel it into doing something that benefits people.

Whether it is hydro energy in Costa Rica, microgrid energy in a village in Africa, heat recycling in Finland, Bathhouse heating in NY, grid balancing in Texas, or biogas from a landfill in Utah, or a pig farm in Ireland, Bitcoin mining companies are turning wasted power into flourishing energy distribution ecosystems that benefit humanity.

Troy Cross once shared with me, “Normally you just get to watch history, but we are all creating it.

On the night that Bill Maher tweeted the biggest “Bitcoin is bad for the environment” throwback I’ve seen on Twitter this year, compete with a 16x overestimation of Bitcoin’s energy consumption, it’s good to remember that for every Bill, there are many more Eduardo’s, quietly getting on with changing the world for the better. You won’t read about them in the media. That’s why this newsletter is so important. Please share his story.

See you next time, where I’ll report on what I learned from 2 EU Bitcoin conferences about Bitcoin adoption.

Housekeeping Notes

Telegram Notifications

You can now receive notification of each new issue via Telegram, just sign up to the Telegram Channel. I highly recommend this as email is prone to spam traps.

Minor typo, Bill Maher, not Mayer.