#34 When Colonial Money Met Digital Hope

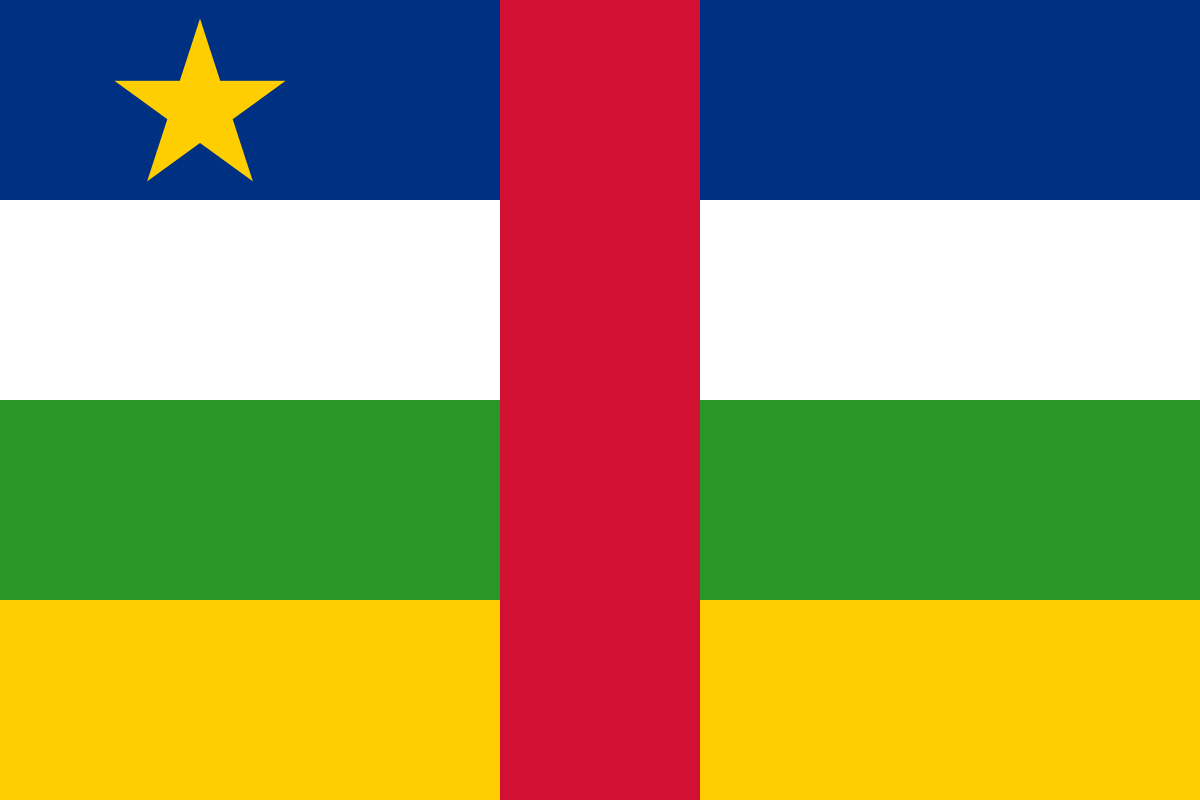

What really happened to Bitcoin Adoption in The Central African Republic

The Central African Republic (CAR) uses the CFA franc. The CFA isn’t just currency—it’s a geopolitical chain, backed by France and governed by the Bank of Central African States (BEAC). Of its 14 member nations, the 6 Central African nations (including CAR) must still deposit 50% of foreign reserves in Paris.

This control over reserves fosters economic dependency, while establishing export markets for French goods at favorable terms. In 1994 for example, the CFA was devalued by half, a policy that was influenced by Western pressure, particularly from the IMF. This caused the cost of imports to leap, leading to exporters (mainly EU based) being able to procure resources from CFA nations at half the cost. Locally the impact was devastating, leading to wage freezes, layoffs, and widespread social unrest across CFA countries

When Central African Republic (CAR) announced in 2022 it was adopting Bitcoin as legal tender, BEAC and its regulatory arm COBAC immediately voided the law, citing violations of the CEMAC Treaty. This wasn’t bureaucracy—it was a warning shot from the monetary guardians of la Françafrique.

Why it mattered: To this day, CAR’s economy relies heavily on IMF bailouts. With $1.7Billion in external debt (61% of GDP), defying BEAC meant risking financial isolation.

The IMF’s Silent Campaign

The IMF moved fast. Within two weeks (May 4, 2022), it publicly condemned CAR’s “risky experiment,” citing legal contradictions with CEMAC’s crypto ban. The move raised “major legal, transparency, and economic policy challenges,” the IMF said: similar the concerns the IMF raised about El Salvador’s Bitcoin adoption: risks to financial stability, consumer protection, and fiscal liabilities. (For context, none of those risks materialized in El Salvador).

But their real weapon was leverage. As CAR’s largest creditor, the IMF tied its new Extended Credit Facility (ECF)—a $191M lifeline—to policy compliance.

The Timeline That Tells All

This table traces the IMF’s shadow campaign:

Key to scuttling CAR’s Bitcoin ambitions was ensuring that the Sango project — a blockchain-hub initiative from the CAR government to sell “e-residency” and citizenship for $60K in Bitcoin — did not proceed.

The Sango Project - coincidence or collusion?

In July 2022, CAR launched the Sango Project. It aimed to raise $2.5B (100% of GDP).

It failed catastrophically. By January 2023, only $2M (0.2% of target) was raised. While IMF reports cite “Technical obstacles with 10% internet penetration” as the reason for the failure, our analysis shows a different picture. Two factors scuttled the project.

Investor flight

A Supreme Court ruling formally blocked the Sango project

However, on closer examination, both of these factors hint at IMF involvement.

Let’s take a closer look at the evidence.